Cryptocurrencies have become increasingly popular over the past several years - as of 2018, there were more than 1,600 of them! And the number is constantly growing. With that has come to an increase in demand for developers of the blockchain (the underlying technology of cryptocurrencies such as bitcoin). The salaries blockchain developers earn show how much they are valued: According to Indeed, the average salary of a full-stack developer is more than $112,000. There’s even a dedicated website for cryptocurrency jobs.

Whether you’re interested in a career as a blockchain developer or you just want to keep up with the latest trends in tech, Simplilearn’s Cryptocurrency Explained video explains what cryptocurrency is and why it’s important will get you off to a good start. Here we’ll recap what’s covered in the video.

A Brief History of Cryptocurrency

In the caveman era, people used the barter system, in which goods and services are exchanged among two or more people. For instance, someone might exchange seven apples for seven oranges. The barter system fell out of popular use because it had some glaring flaws:

- People’s requirements have to coincide—if you have something to trade, someone else has to want it, and you have to want what the other person is offering.

- There’s no common measure of value—you have to decide how many of your items you are willing to trade for other items, and not all items can be divided. For example, you cannot divide a live animal into smaller units.

- The goods cannot be transported easily, unlike our modern currency, which fits in a wallet or is stored on a mobile phone.

After people realized the barter system didn’t work very well, the currency went through a few iterations: In 110 B.C., an official currency was minted; in A.D. 1250, gold-plated florins were introduced and used across Europe; and from 1600 to 1900, the paper currency gained widespread popularity and ended up being used around the world. This is how modern currency as we know it came into existence.

Modern currency includes paper currency, coins, credit cards, and digital wallets—for example, Apple Pay, Amazon Pay, Paytm, PayPal, and so on. All of it is controlled by banks and governments, meaning that there is a centralized regulatory authority that limits how paper currency and credit cards work.

Traditional Currencies vs. Cryptocurrencies

Imagine a scenario in which you want to repay a friend who bought you lunch, by sending money online to his or her account. There are several ways in which this could go wrong, including:

- The financial institution could have a technical issue, such as its systems are down or the machines aren’t working properly.

- Your or your friend’s account could have been hacked—for example, there could be a denial-of-service attack or identity theft.

- The transfer limits for your or your friend’s account could have been exceeded.

There is a central point of failure: the bank.

This is why the future of currency lies with cryptocurrency. Now imagine a similar transaction between two people using the bitcoin app. A notification appears asking whether the person is sure he or she is ready to transfer bitcoins. If yes, processing takes place: The system authenticates the user’s identity, checks whether the user has the required balance to make that transaction, and so on. After that’s done, the payment is transferred and the money lands in the receiver’s account. All of this happens in a matter of minutes.

Cryptocurrency, then, removes all the problems of modern banking: There are no limits to the funds you can transfer, your accounts cannot be hacked, and there is no central point of failure. As mentioned above, as of 2018 there are more than 1,600 cryptocurrencies available; some popular ones are Bitcoin, Litecoin, Ethereum, and Zcash. And a new cryptocurrency crops up every single day. Considering how much growth they’re experiencing at the moment, there’s a good chance that there are plenty more to come!

Moving forward, let us discuss what is cryptocurrency.

What is Cryptocurrency?

A cryptocurrency is a coded string of data representing a currency unit. Peer-to-peer networks called blockchains monitor and organize cryptocurrency transactions, such as buying, selling, and transferring, and also serve as secure ledgers of transactions. By utilizing encryption technology, cryptocurrencies can serve as both a currency and an accounting system.

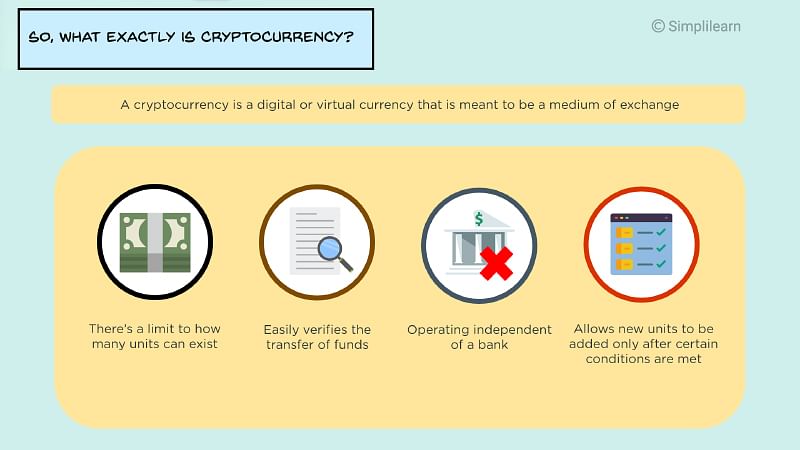

A cryptocurrency is a digital or virtual currency that is meant to be a medium of exchange. It is quite similar to real-world currency, except it does not have any physical embodiment, and it uses cryptography to work.

Because cryptocurrencies operate independently and in a decentralized manner, without a bank or a central authority, new units can be added only after certain conditions are met. For example, with Bitcoin, only after a block has been added to the blockchain will the miner be rewarded with bitcoins, and this is the only way new bitcoins can be generated. The limit for bitcoins is 21 million; after this, no more bitcoins will be produced.

In the evolving landscape of finance and technology, the role of cybersecurity in the realm of cryptocurrency is paramount. A Cyber security BootCamp provides an ideal platform for individuals to delve into the intricacies of securing digital assets and transactions within the cryptocurrency domain. By gaining expertise in cryptographic principles, blockchain security, and risk management, participants are better equipped to address the unique challenges posed by digital currencies.

How Does Cryptocurrency Work?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. A cryptocurrency is difficult to counterfeit because of this security feature. Cryptocurrencies are decentralized and not subject to government or financial institution control.

- And the decentralized control of each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.

- The most famous cryptocurrency is Bitcoin, which was created in 2009.

- Cryptocurrencies are designed through mining, which uses computing power to solve complex math problems that verify transactions on the blockchain, the public ledger of all cryptocurrency transactions. And miners are rewarded with cryptocurrency for their efforts.

Cryptocurrency trading is speculative and complex, and it involves significant risks. Prices can fluctuate on any given day. Given the price volatility, cryptocurrency is only suitable for some investors. Therefore, cryptocurrency should be considered a high-risk investment. Before investing, understand the risks involved and consult a financial advisor.

Benefits of Cryptocurrency

With cryptocurrency, the transaction cost is low to nothing at all—unlike, for example, the fee for transferring money from a digital wallet to a bank account. You can make transactions at any time of the day or night, and there are no limits on purchases and withdrawals. And anyone is free to use cryptocurrency, unlike setting up a bank account, which requires documentation and other paperwork.

International cryptocurrency transactions are faster than wire transfers too. Wire transfers take about half a day for the money to be moved from one place to another. With cryptocurrencies, transactions take only a matter of minutes or even seconds.

How to Buy Cryptocurrency?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and control the creation of new units. And cryptocurrencies are often bought with "fiat" or traditional currency like US dollars or euros. However, they can also be bought with cryptocurrencies like Bitcoin or Ethereum. First, you must set up a digital wallet to store your coins to buy cryptocurrency. You can then buy coins on a cryptocurrency exchange using your fiat currency or another cryptocurrency.

There are a few different ways to buy cryptocurrency.

- You can use an online cryptocurrency exchange such as Coinbase, Bitstamp, or Kraken to purchase cryptocurrency with a credit/debit card, bank transfer, or other payment methods.

- You can use a peer-to-peer exchange such as LocalBitcoins or Bisq to purchase cryptocurrency directly from other users.

- You can trade cryptocurrency for other types of assets, such as stocks, through cryptocurrency trading platforms.

How to Store Cryptocurrency?

Storing cryptocurrency securely is an integral part of investing in cryptocurrencies. Cryptocurrency can be stored in several ways, but the most common is through a digital wallet. A digital wallet can be software-based, web-based, or hardware-based.

- Software-based wallets are installed on a computer or mobile device, while web-based wallets are accessed through a web browser.

- Hardware-based wallets are physical devices that store cryptocurrency offline.

Digital wallets are used to store, send, and receive cryptocurrency. They are generally more secure than other wallets and not subject to hacking or malware. However, digital wallets can be recovered or stolen if adequately protected.

It is also essential to use strong passwords and two-factor authentication to protect the wallet. Additionally, using an address generated through a secure random number generator can help protect against address reuse and other security risks. And it would be best to keep your private key private, which can access your cryptocurrency.

What Can You Buy with Cryptocurrency?

You can buy various items with cryptocurrency, including digital assets such as domain names, gift cards, and software. You can also purchase physical objects such as electronics, furniture, artwork, and clothing. Additionally, some online retailers and physical stores accept cryptocurrency as payment. In addition, cryptocurrency can also help to invest in various businesses and projects. For example, you could use cryptocurrency to invest in a new start-up or to help fund a new product or service.

What is Cryptography?

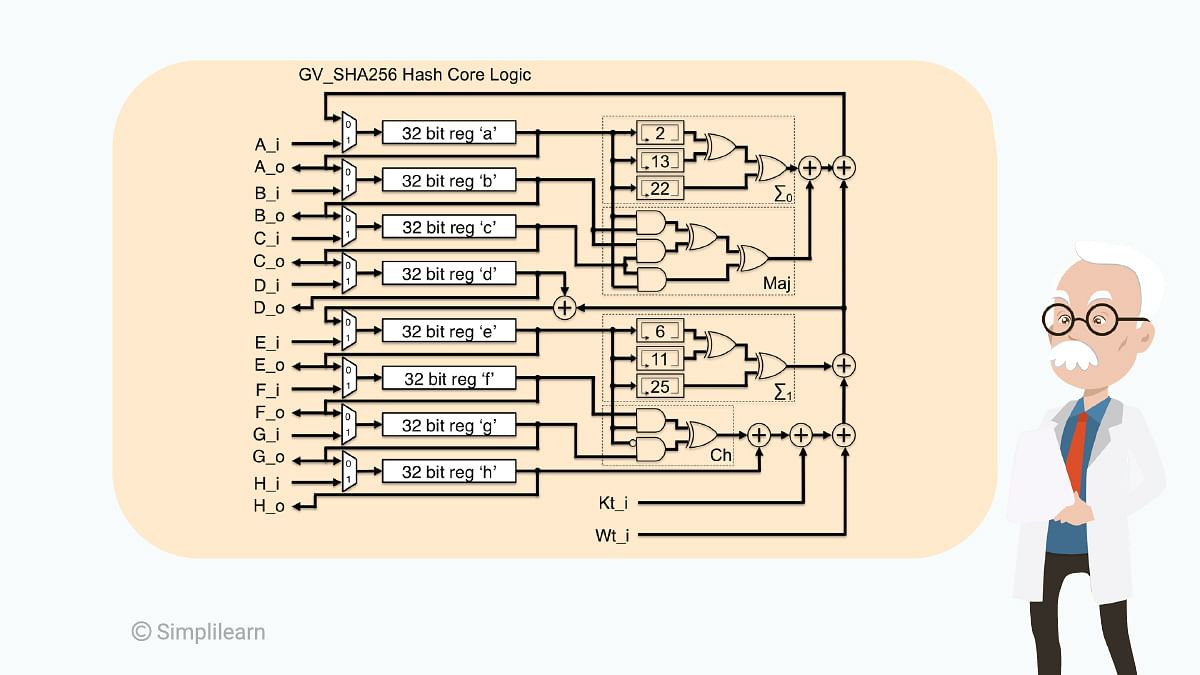

Cryptography is a method of using encryption and decryption to secure communication in the presence of third parties with ill intent—that is, third parties who want to steal your data or eavesdrop on your conversation. Cryptography uses computational algorithms such as SHA-256, which is the hashing algorithm that Bitcoin uses; a public key, which is like a digital identity of the user shared with everyone; and a private key, which is a digital signature of the user that is kept hidden.

Cryptography in Bitcoin Transactions

In a normal bitcoin transaction, first, there are the transaction details: whom you want to send the bitcoins to and how many bitcoins you want to send. Then the information is passed through a hashing algorithm. Bitcoin uses the SHA-256 algorithm. The output is then passed through a signature algorithm with the user’s private key, used to uniquely identify the user. The digitally signed output is then distributed across the network for other users to verify. This is done by using the sender’s public key.

The users who check the transaction to see whether it’s valid or not are known as miners. After this is done, the transaction and several others are added to the blockchain, where the details cannot be changed. The SHA-256 algorithm looks something like in the image below.

You can see how complicated it is, meaning it’s safe to say that the encryption is very difficult to hack.

Bitcoin vs. Ethereum

You now know that Bitcoin is a digital currency that is decentralized and works on the blockchain technology and that it uses a peer-to-peer network to perform transactions. Ether is another popular digital currency, and it’s accepted in the Ethereum network. The Ethereum network uses blockchain technology to create an open-source platform for building and deploying decentralized applications.

Similarities

Bitcoin and ether are the biggest and most valuable cryptocurrencies right now. Both of them use blockchain technology, in which transactions are added to a container called a block, and a chain of blocks is created in which data cannot be altered. For both, the currency is mined using a method called proof of work, involving a mathematical puzzle that needs to be solved before a block can be added to the blockchain. Finally, both bitcoin and ether are widely used around the world.

Differences

Bitcoin is used to send money to someone. The way it works is very similar to the way real-life currency works. Ether is used as a currency within the Ethereum network, although it can be used for real-life transactions as well. Bitcoin transactions are done manually, which means you have to personally perform these transactions when you want them done. With ether, you have the option to make transactions manual or automatic—they are programmable, which means the transactions take place when certain conditions have been met. As for timing, it takes about 10 minutes to perform a bitcoin transaction—this is the time it takes for a block to be added to the blockchain. With ether, it takes about 20 seconds to do a transaction.

There is a limit to how many bitcoins can exist: 21 million. This number is supposed to be reached by the year 2140. Ether is expected to be around for a while and is not to exceed 100 million units. Bitcoin is used for transactions involving goods and services, and ether uses blockchain technology to create a ledger to trigger a transaction when a certain condition is met. Finally, Bitcoin uses the SHA-256 algorithm, and Ethereum uses the ethash algorithm.

As of May 2020, 1 bitcoin equals $8741.81 dollars, and 1 ether equals $190.00.

Cryptocurrency Fraud and Cryptocurrency Scams

Cryptocurrency fraud and scams are becoming increasingly common as the popularity of cryptocurrencies grows. Cryptocurrency fraud is any form of deceptive or criminal activity or deliberate manipulation of the value of digital currencies, whether through hacking, fraud, market manipulation, or other malicious activities.

On the other hand, cryptocurrency scams involve any fraudulent activity or schemes related to the acquisition, trading, or use of virtual currencies. These scams are typically perpetrated through online marketplaces, social media platforms, or other channels. Such scams include fraudulent online exchanges, pump-and-dump schemes, and pyramid schemes.

Scammers can defraud investors in a few different ways, including

- Ponzi schemes: In a Ponzi scheme, investors are promised unrealistic returns and paid back with money from new investors. Eventually, the scheme collapses when there need to be more new investors to keep it going.

- Pyramid schemes: Similar to a Ponzi scheme, investors are promised unrealistic returns in a pyramid scheme. However, instead of being paid back with money from new investors, they are paid back with their own or from other investors in the scheme.

- Fake ICOs: An ICO, or initial coin offering, is a way for a company to raise money by selling digital tokens. Unfortunately, some scammers create fake ICOs to steal investors' money.

- Hacking: Hacking is a major issue in the cryptocurrency world. Hackers can steal money from exchanges, wallets, and individual investors.

These are just a few of the ways that scammers can defraud investors. Therefore, it's essential to know the risks before investing in cryptocurrencies.

Is Cryptocurrency Safe?

Cryptocurrency is generally considered safe, although your account's security depends on the measures you take to protect it. For example, using strong passwords, enabling two-factor authentication, and never sharing your private keys or passwords with anyone is important.

4 Tips to Invest in Cryptocurrency Safely

- Research and Understand the Market: Before investing in cryptocurrency, it is crucial to research and understand the market. Understanding the technology, benefits, and risks associated with investing in cryptocurrency.

- Use Reputable Exchange Platforms: Investors should only use reputable exchanges to buy and sell cryptocurrency. Reputable exchange platforms have built-in security measures that protect investors from theft and fraud.

- Store Cryptocurrency Securely: It is vital to store cryptocurrency securely after purchasing cryptocurrency. Investing in a secure wallet is one of the best ways to protect cryptocurrencies from theft and fraud.

- Diversify Investments: Diversifying investments can help to manage the risks associated with investing in cryptocurrency. For example, buy different types of cryptocurrency to spread out the threat.

The Future of Cryptocurrency

The world is clearly divided when it comes to cryptocurrencies. On one side are supporters such as Bill Gates, Al Gore and Richard Branson, who say that cryptocurrencies are better than regular currencies. On the other side are people such as Warren Buffet, Paul Krugman, and Robert Shiller, who are against it. Krugman and Shiller, who are both Nobel Prize winners in the field of economics, call it a Ponzi scheme and a means for criminal activities.

In the future, there’s going to be a conflict between regulation and anonymity. Since several cryptocurrencies have been linked with terrorist attacks, governments would want to regulate how cryptocurrencies work. On the other hand, the main emphasis of cryptocurrencies is to ensure that users remain anonymous.

Futurists believe that by the year 2030, cryptocurrencies will occupy 25 percent of national currencies, which means a significant chunk of the world would start believing in cryptocurrency as a mode of transaction. It’s going to be increasingly accepted by merchants and customers, and it will continue to have a volatile nature, which means prices will continue to fluctuate, as they have been doing for the past few years.

That wraps up our cryptocurrency tutorial. If you’d like to learn more about blockchain (the underlying technology of cryptocurrencies such as bitcoin), check out Full Stack Java Developer.

If you have any questions in the article “what is cryptocurrency”, please ask your questions in the comment section below. Our experts will get back to you at the earliest.

FAQs

1. How do you buy Cryptocurrencies?

Bitcoin may be traded on exchanges, which provide investors with a safe and secure platform. The future has here with cryptocurrencies. To begin investing, you must first choose a reputable cryptocurrency exchange where you may buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, Tron, and others. Select a Broker or a Crypto Exchange. You must first select a broker or cryptocurrency exchange to purchase bitcoin. Then you must create and validate Your Account. Make a cash deposit to begin investing, and then place your cryptocurrency order. Choose a Storage Method.

2. What is the point of Cryptocurrency?

Anyone can send and receive money anywhere, using the peer-to-peer payment system. In the real world, cryptocurrency transactions are not carried around and exchanged as tangible money but as digital entries to an online database that identifies specific transactions. The benefits of cryptocurrencies include cheaper and quicker money transactions and decentralized systems that do not fail at a single point.

3. Can you generate Cryptocurrency?

Anyone may establish a cryptocurrency, but it takes time, money, and other resources, as well as extensive technical skills. The primary possibilities are creating your own blockchain, modifying an existing one, creating a coin on an existing one, or hiring a blockchain engineer. The cost of bitcoin production ranges from $10,000 to $30,000, depending on the chosen option.

4. What are the most popular Cryptocurrencies?

Consider Ravencoin, Ethereum, and Bitcoin to purchase today and retain forever. Due to their volatility, cryptocurrencies are best suited for those that can tolerate risk. For these investors, investing in the leading cryptocurrencies now, while the market is unreliable, may pay off in the long term. One of the biggest cryptocurrency exchanges in the world, Binance, has its own coin called BNB. Although Binance Coin was first designed as a token to pay for reduced transactions, it is now being used to make payments and buy a variety of goods and services.

5. Are Cryptocurrencies Securities?

On the Chicago Mercantile Exchange, the world's largest and most complex financial market, crypto derivatives like Bitcoin futures are offered. According to the Securities and Exchange Commission (SEC), Ethereum and Bitcoin are not securities.

6. How do cryptocurrencies work?

A digital currency, or cryptocurrency, is an alternative payment method developed utilizing encryption methods. By utilizing encryption technology, cryptocurrencies may act as both a medium of exchange and a virtual accounting system. You need a cryptocurrency wallet in order to utilize cryptocurrencies. Blockchain networks power cryptocurrencies. A blockchain is simply a growing collection of digital blocks that serve as a ledger. The distributed ledger of a blockchain allows for the storage of data across several computers in a network. The nodes are the individual computers that validate and store the data.

7. How to invest in cryptocurrency?

Opt for the bitcoin exchange of your choice. Create an account with the bitcoin exchange after that. Spend fiat money to fill your account. Choose the cryptocurrency that you wish to purchase. Put up a purchase order for the cryptocurrency of your choice.

8. What are the key steps to buy cryptocurrency?

Step 1: Pick the best cryptocurrency exchange.

Step 2: Open a trading account and confirm your email. Connect your phone now.

Step 3: Verify your identification in step three. Fund Your Account next.

Step 4: Purchasing and Investing in Cryptocurrency.

Step 5: Store your cryptocurrency.

Step 6: Choose a strategy in the last step.

9. What is the minimum amount you can invest in cryptocurrencies?

You may buy or sell digital money for as low as $2.00 ($2 or €2) that is denominated in your home currency.

10. Can cryptocurrencies be used to make online purchases?

Definitely, despite the fact that cryptocurrencies are not a commonly utilized payment option, a number of businesses have started to accept them in return for their goods and services. Online purchases are increasingly being made using cryptocurrencies. According to Wagner, a number of merchants now accept Bitcoin. You may shop on Overstock.com to buy furniture for your home with cryptocurrency. You may even embark on a spending spree at Nordstrom, which also accepts Bitcoin from clients.

11. How many Cryptocurrencies are there?

There are already more than 12,000 cryptocurrencies, and the growth rate is simply astounding. Cryptocurrencies have more than doubled in number between 2021 and 2022. Toward the end of 2021, the market added approximately 1,000 new cryptocurrencies per month.

12. What are the different types of Crypto?

Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), and Binance Coin (BNB) are some of the popular ones.